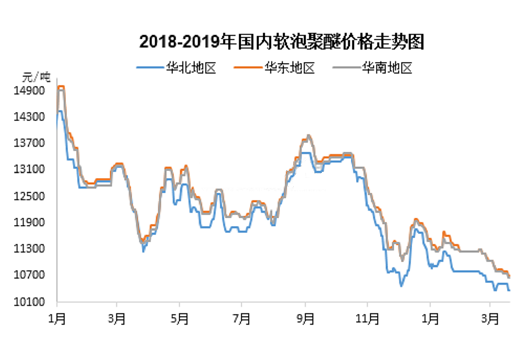

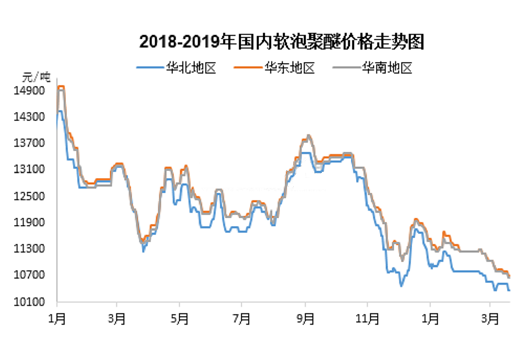

Figure 1 price trend of domestic soft foam polyether in 2018-2019

In the first quarter of 2019, soft foam polyether showed an overall downward trend of shock. In the first quarter, affected by the new year's day and the Spring Festival, the inventory of polyether factory was under pressure. After the festival, affected by the slow start of terminal demand, the delivery of polyether has been tepid and slow, and the inventory transfer of polyether factory was slow. The concentration of imported polyether to port also increased the pressure of delivery of polyether. However, after the festival, the sponge factory's orders have been flat, the supply and demand of filling are not enough, and the price of raw materials and cyclopropane has been reduced. The price of soft foam has been weakened, and the soft foam polyether market in Shandong and North China has been closed at 10300-10450 yuan / ton, or 1.89% in March 19th. East China market closed at 10400-10700 yuan / ton, down 3.17%; South China market closed at 10400-10700 yuan / ton, down 3.62%. At present, the price of soft foamed polyether drops to the lowest point in 2018-2019.

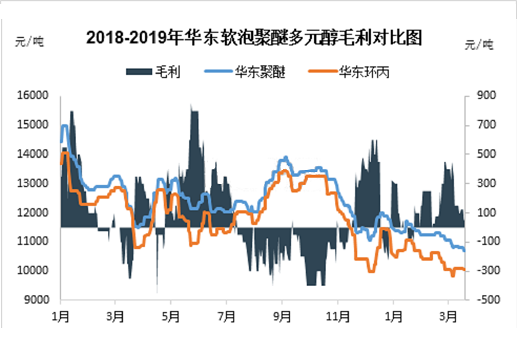

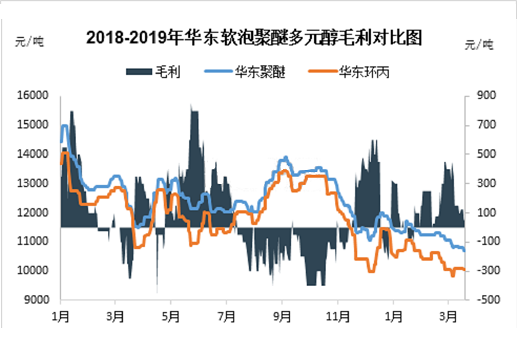

Figure 2 Comparison of gross profit of East China soft foam polyether polyol in 2018-2019

Although the price trend of the soft bubble in the first quarter of 2019 is hard to be optimistic, the profitability of the soft bubble is a surprise. The average gross profit of soft foam polyether in the first quarter of 2019 is 153 yuan / ton (theoretical data), down 15 yuan / ton (theoretical data), down 8.92% compared with the same period of 2018, and up 128 yuan / ton (theoretical data), up 512% compared with the fourth quarter of 2018. It can be seen from the figure that the gross profit distribution in the first quarter of 2019 is more uniform than that in the first quarter of 2018, and the profit time is longer than that in the first quarter of 2018. The profit of the soft bubble in 2019 is mainly concentrated in January, and the profit of the soft bubble in 2019 is relatively scattered in each month. The profit peaks and lows in 2018 and the first quarter of 2019 are all distributed in the first quarter of 2018.

As a kind of chemicals highly dependent on raw materials, the price dependence of soft foam polyether on cyclopropane is more than 90%. Since November 2018, the price difference between soft foam polyether and cyclopropane has been relatively large. The average price difference is 763 yuan / ton (theoretical data). In the first quarter of 2019, the average price difference between soft foam and cyclopropane is 755 yuan / ton (theoretical data), with a growth rate of 20.8% on a month-on-month basis and a growth rate of 32.92% on a year-on-year basis. Although the price of soft foam polyether and raw material cyclopropane overall showed a downward trend, but the decline of soft foam polyether was 4.10%, cyclopropane was 5.14%, cyclopropane dropped more than soft foam, ensuring the gross profit space of soft foam.

In the first quarter of 2019, the delivery pressure of soft foam polyether has been high. After the Spring Festival, the inventory of polyether factory needs to be digested. When imported polyether is collected in port, the high level of port polyether inventory is hard to be eliminated. However, the downstream sponge factory still has the raw material inventory to be consumed, the terminal demand is not good, and the delivery of polyether is not easy. The high level of social inventory and weak downstream demand make the price of polyether slow down. After the Spring Festival, imported cyclopropane is concentrated in the port, and the port inventory is high, but the weak terminal demand and poor delivery of polyether make the demand of cyclopropane weak, and the bargaining power of soft foam for raw materials is enhanced, making the drop of soft foam less than cyclopropane.

label:

Home

Home